Cryptocurrencies and Blockchain: Innovation or Fraud?

Are cryptocurrencies and blockchain technology the future of the financial sector and payments, or just a passing phenomenon hiding potential scams? This question divides experts from around the world.

Lack of Definitive Answer

Many people wonder about the real usefulness and scalability of cryptocurrencies. Are they truly practical in everyday life or merely a speculative bubble? The lack of a definitive answer leaves room for various interpretations.

JPMorgan Chase and Approach to Blockchain

One of the more intriguing cases is JPMorgan Chase, utilizing blockchain technology while maintaining skepticism towards cryptocurrencies. This shows how large financial institutions approach these issues.

Situation in Japan and India

On opposite ends of the spectrum are Japan, considering easing regulations on cryptocurrencies due to the growing number of companies involved in blockchain technology, and India, which despite regulatory attempts is leading the world in the 2024 „Global Adoption Index”.

Reserve Bank of Australia and Lack of Justification for Digital Currencies

The Reserve Bank of Australia signals a lack of clear justification for introducing a digital currency at the retail level, demonstrating that even financial institutions are engaging in discussions about cryptocurrencies.

Central Bank Digital Currencies (CBDCs)

It’s not only commercial banks interested in cryptocurrencies. Currently, 134 countries are exploring the possibility of introducing Central Bank Digital Currencies (CBDCs), with three countries having already implemented them, which could have significant implications for the future of payment systems worldwide.

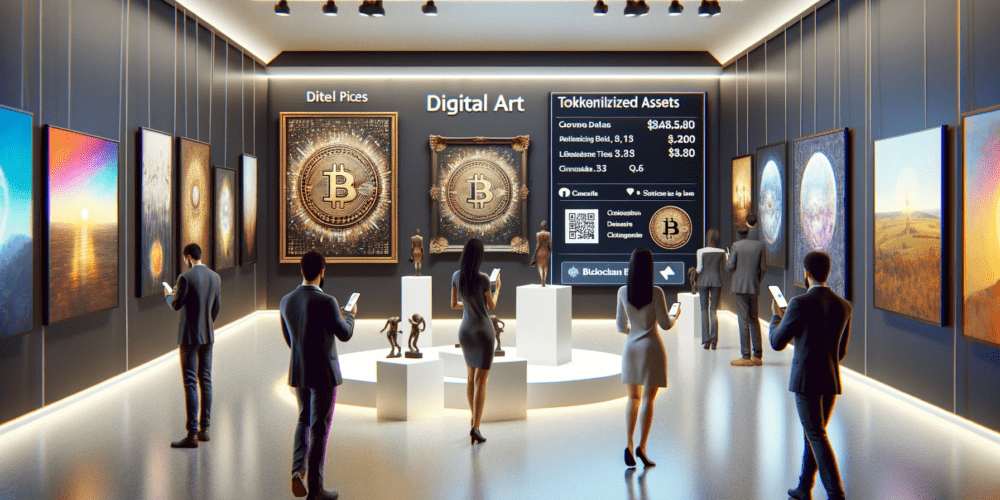

Visa and dtpay Collaboration

An example of integrating traditional payment systems with cryptocurrency technology is the collaboration between Visa and dtpay, enabling the conversion of cryptocurrencies to fiat and digital payments, which could accelerate the acceptance of cryptocurrencies in the market.

Regulatory Issues

The process of regulation regarding cryptocurrencies does not always proceed smoothly. The U.S. financial supervisory agency, the SEC, recently reached settlements with both the audit firm Prager Metis and the brokerage platform eToro regarding various irregularities, showing that the cryptocurrency market still faces several challenges.