16 Years Since the Bitcoin Manifesto – the Beginning of a Financial Revolution

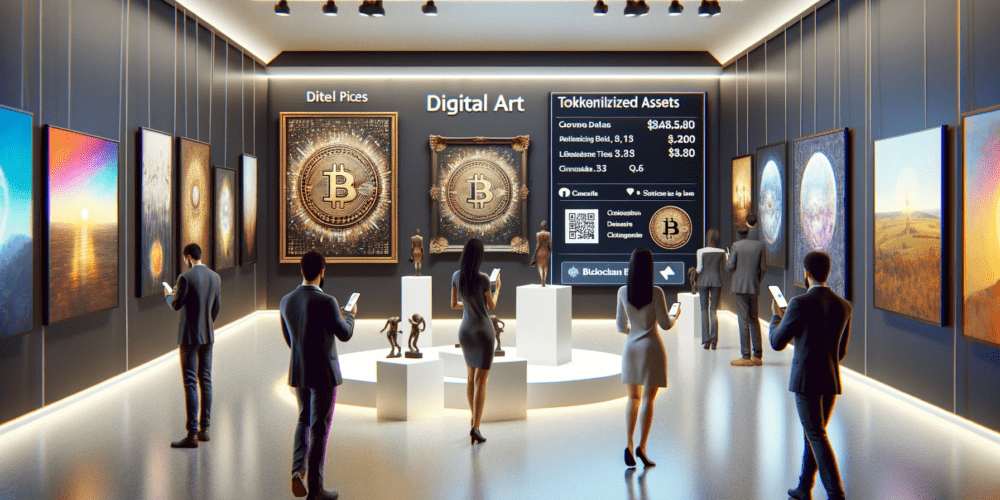

Today marks the 16th anniversary of the Bitcoin manifesto, a document that sparked a revolution in the world of finance. Since then, this cryptocurrency has evolved, gaining increasing popularity and influence on the global economy.

Bitcoin – Deflationary Currency Without Central Bank Control

Bitcoin is a digital, decentralized currency, independent of financial institutions or central banks. It is also a deflationary currency, meaning its supply is limited, distinguishing it from traditional fiat currencies.

Critics versus Supporters of Bitcoin

While supporters highlight the benefits of Bitcoin as „digital gold” and its potential as a payment network, critics, like Ulrich Bindseil from the European Central Bank, primarily see speculative risks in this cryptocurrency.

Evolution of Bitcoin – From Electronic Cash to Store of Value

Initially intended to function as electronic cash, Bitcoin has transformed over time into primarily a store of value, serving as an alternative to traditional forms of investment.

Bitcoin and Central Banks, as well as Innovations in the Cryptocurrency Ecosystem

Bitcoin has faced criticism from central banks, which are simultaneously experimenting with cryptocurrency technology to create their own digital currencies. However, this initial movement sparked the cryptocurrency ecosystem and innovations such as stablecoins and DeFi.

The Role of Bitcoin in Global Payments

Despite the controversies surrounding it, Bitcoin continues to evolve, expanding its network and ability to process transactions in global payments. Its circulating supply has become increasingly attractive in the face of issues with the purchasing power of traditional fiat currencies.

Summary – Bitcoin as an Alternative to Fiat Currencies

Bitcoin currently stands at a crossroads, between central bank skepticism and growing social interest as a potential alternative to traditional fiat currencies. Its impact on the world of finance is becoming more apparent, both in terms of innovations and discussions about the future of financial systems.